If you listen to the Democrats and the media (but I repeat myself), the problem is that damned old Bush and McCain have been lavishing tax cuts on those corporations, and keeping your money from you. They need to be taxed more. They hardly pay any taxes at all, right?

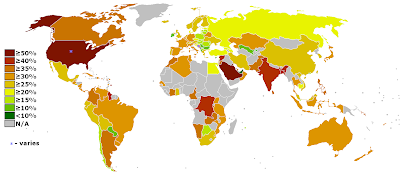

Well, guess what the US corporate tax rate is as compared to the rest of the world? OK you've already peeked at the map so you know: it's one of the highest; greater than 50%.

Now, if you were the CEO of a big new corporation, and you suspected tough times were coming, where do you think you'd like to locate? Put it another way: can you find Ireland, that fast growing firecracker technology mecca, on this map? Even if you've got the map reading skills of a Miss America contestant, you can. (hint: it's green)

[Ireland] changed dramatically in the mid 1990s as the result of a prodigious economic boom, known as the "Celtic Tiger" (as in "tiger economy"). This was led by a surge in inward investment in high end industries in services, and lower taxation levels. From 2002, this was augmented by low interest rates set by the European Central Bank which encourage private sector consumption. In July 2006, a survey undertaken by Bank of Ireland Private Banking showed that, of the top 8 leading OECD nations, the Republic of Ireland was ranked the second wealthiest per capita country in the world, showing an average wealth per head of nearly €150,000 (~ $190,000).

What? The people are doing well? Second only to Japan? How can they do well if the blood-sucking corporations are only paying a 12% tax?

Obama doesn't like to admit that we've already got one of the highest corporate tax rates in the world, but when confronted with it once, he said that because of loopholes, none of them really pay the full rate. Of course, he wants to close those loopholes; he's said as much.

So close the loopholes, and punish the job-shippers. Right. But what do we do when we want a corporation to locate in a certain area? How do we get companies to move into a technology corridor? Just put up a sign and hope they notice? Invite them? No. We lower the local taxes for corporations who move to that area. And lowering just the local taxes gets companies to relocate. We already know this is how the world works. But somehow Barack Obama thinks he can create new jobs by increasing taxes on US corporations.

So put away your map reading skills and take out your math arsenal. Ready? OK, which is more: 1.) a 12.5 % tax on a big corporation that supplies jobs and their associated taxes, OR, B.) a 50% tax on a corporation that isn't there?

Don't buy the silly hype that your money is being kept from you by a few fabulously rich bastards. Obama's socialist revolution could take all their money and nothing would change for you. We all do well in a strong, growing economy. I don't know what it will take to correct this financial crisis, but whatever it takes, and however long it takes, we want big businesses, medium businesses, and small businesses to be comfortable with our tax structure. Squeeze them too much, and those who can leave, will.

And get a clue: If you have a wonderful feast on your plate, it matters not one little bit what the guy in the next room has got. What does it matter if he's got a golden fork? What matters to you is what's on your plate. Don't let the slick empty suit manipulate you by playing on your envy.

0 comments:

Post a Comment